Did you know that self-storage has been one of the fastest growing industries in commercial real estate for nearly 40 years? Whether moving to a new home or storing business inventory, great storage rentals are always needed.

Since the beginning of the pandemic in 2020, self-storage has been an affordable alternative for many people and businesses to keep their assets secure.

If you’re considering a steel building to start a storage business–or for your own storage needs, we’ve compiled a conclusive list of self-storage industry statistics and trends to know.

Read on to learn more about this booming industry and its positive outlook for 2024.

Market Overview of Self-Storage

The success of the self-storage industry shows that even the standard garage size does not have enough storage space for the average household. Simply put, U.S. consumers own too much stuff and opt for storage units to shelter their belongings.

- In the past four years, the annual revenue for self-storage grew over 13 percent, from $39 billion in 20201 to an estimated $44.33 billion in 2024.15

- As of 2024, 52,301 self-storage facilities are operating in the U.S.2

- Over half of the available self-storage space is owned by small operators.3

- The average occupancy of storage facilities is 96.5 percent.4

- 90 percent of worldwide self-storage inventory is in the U.S.5

- The average size of a self-storage facility in the U.S. is approximately 56,900 square feet,6 slightly larger than a football field.

- Average storage unit costs $132 per month for a small 10’x10’ unit without climate control and $152 with it.8

- Over one-fifth of renters in the U.S. are using self-storage.10

- With 54 percent of their generation as renters, Gen Xers use self-storage more than any other group.14

- Over 50 percent of female renters use self-storage.10

- 65 percent of all self-storage renters have a garage.6

Self-Storage Market at a Glance

90 percent of worldwide self-storage inventory is in the U.S.

Statista

In 2024, the annual revenue for self-storage is an estimated $44.33 billion

Cushman & Wakefield

Over one-fifth of renters in the U.S. are using self-storage.

RentCafe

65 percent of all self-storage renters have a garage.

Self Storage Association

Gen-Xers use self-storage more than any other group.

SpareFoot

Over 50 percent of female renters are self-storage users.

SpareFoot

Industry Performance Insights

During the 2020 COVID-19 outbreak, storage facilities maintained business as many people transitioned to remote work and businesses reduced office space for social distancing protocols. Since then, the self-storage industry continues to grow year over year—proving to be a worthy investment opportunity.

- Over the past 40 years, the self-storage industry has been one of the fastest-growing sectors of the U.S. commercial real estate industry.6

- The top three leading self-storage real estate investment trusts (REITs) in the U.S. are Public Storage (PSA), Extra Space Storage, Inc. (EXR), and Life Storage, Inc. (LSI).7

- U.S. self-storage REITs on the Dow Jones showed 59.1 percent year-to-date returns, which had a significantly stronger performance than indexes for other asset types.4

- The average rental cost per square foot of self-storage units in the U.S. is $1.01.11

- The national average to rent self-storage units of all sizes is $96.25 per month.11

- Self-storage facilities in the U.S. employ over 170,000 people, with an average of 3.5 employees per facility.6

Self-Storage Performance Insights

The average rental cost per square foot in the U.S. is $1.16.

SpareFoot

Self-storage facilities in the U.S. employ over 170,000 people, with an average of 3.5 employees per facility.

Self Storage Association

The national average monthly cost to rent a self-storage unit (of all sizes) is $108.18.

SpareFoot

The top three leading self-storage real estate investment trusts (REITs) in the U.S. are:

- Public Storage (PSA)

- Extra Space Storage Inc. (EXR)

- Life Storage Inc. (LSI.)

Statista

Over the past 40 years, the self-storage industry has been one of the fastest growing sectors of the U.S. commercial real estate industry.

Self Storage Association

U.S. self-storage REITs on the Dow Jones showed 59.1 percent year-to-date returns, which had a significantly stronger performance than indexes for other asset types.

S&P Global

Self-Storage Supply Data

Metropolitan areas of major U.S. cities house the most storage facilities, mostly due to tighter living spaces in comparison to rural areas. It’s also evident that storage units are not limited to household items but also serve as shelter for RVs, boats, and other vehicles.

Entering 2024, as more stakeholders push for sustainability and environmental awareness, an increasing number of storage warehouses have adopted energy-efficient building equipment and technological upgrades.

- The top three cities providing the most self-storage facilities are Dallas, TX, with 1,260; Houston, TX with 1,079; and New York, NY, with 1,023.1

- There are approximately over 50,000 storage facilities in the U.S.12

- Self-storage facilities contain an average of 546 units each.6

- Nearly 20 percent of self-storage facilities offer parking and/or storage for boats and RVs.6

- Construction spending on self-storage increased 584 percent over a five-year span1, and exceeded an all-time record $6.99 billion in 2023.2

- Knoxville, TN, has the fastest-growing self-storage market.12

- At $216 per month, San Francisco, CA, holds the most expensive rental rate for a 10’x10’ unit (without climate control).8

- In the U.S., the average available self-storage space per person is 5.9 square feet.2

- The number of facilities under development or in planning stages is equal to about 10 percent of existing inventory nationwide.8

- About one-third of self-storage facilities offer truck rentals.6

- The top 3 energy-efficient upgrades among self-storage facilities and warehouses are LED lighting, electric-based cooling systems, and solar panel installation.16

Self-Storage Supply Data

Self-storage facilities contain an average of 546 units each.

Self Storage Association

The average available self-storage space per person is 5.9 square feet.

SpareFoot

There are approximately over 50,000 storage facilities in the U.S. as of 2022.

Statista

About one-third of self-storage facilities offer truck rentals.

Self Storage Association

The top three cities providing the most self-storage facilities are:

- Dallas, TX, with 1,260

- Houston, TX, with 1,079

- New York, NY, with 1,023

Cushman & Wakefield

Nearly 20 percent of self-storage facilities offer parking and/or storage for boats and RVs.

Self Storage Association

Demand Statistics for Personal Storage

Self-storage units are increasingly in demand. Find out the top reasons people use them and the most popular unit sizes.

- Over 1.5 million self-storage units in the U.S. are rented to military personnel.6

- As unemployment increased and more people downsized their homes during the COVID-19 pandemic, the demand for self-storage surged.9

- The most demanding time of the year for self-storage is May through September, the most common season Americans move into new homes.11

- Over three-quarters of self-storage tenants are homeowners.1

- The average storage rental duration is 10 months.1

- About a third of all self-storage renters expect to rent for more than two years.6

- Moving is a major driver of the self-storage industry—42 percent of renters used a storage unit while switching homes.10

- The top five reasons people use self-storage are for moving purposes, lack of space at home, change in household size, downsizing, and business purposes.10

- The two most frequent types of stored items are furniture and clothes.10

- Small (5’x10’) and medium (10’x10’) storage units are the most common sizes available.10

- A 10’x10’ storage unit is the most popular size among renters.11

- About 11 percent of households rent a storage unit.2

- The three most in-demand cities for self-storage units are Los Angeles, CA; Las Vegas, NV; and Phoenix, AZ.2

- Private businesses are one of the main groups that rely on self-storage facilities to store excess inventory.12

Self-Storage Demand Statistics

The top five reasons people use self-storage are:

- Moving purposes

- Lack of space at home

- Change in household size

- Downsizing

- Business purposes

RentCafe

Moving is a major driver of the self-storage industry— 42 percent of renters used one while switching homes.

RentCafe

About 10 percent of households are renting a storage unit.

Statista

Furniture and clothes are the two most frequent types of stored items.

RentCafe

The average storage rental duration is 10 months.

Cushman & Wakefield

The most demanding time of the year for self-storage is May through September, when most Americans are moving to new homes.

SpareFoot

Management Trends

Constructing and effectively running a storage facility has its fair share of expenses. Fortunately, the annual revenue of the industry far exceeds the total costs of operations.

- Property taxes, management fees, and advertising are the top expenses for owners of storage facilities.1

- On average, property taxes account for nearly a third of self-storage property expenses.1

- U.S. self-storage facilities pay a total of over $3.25 billion in property taxes to local government jurisdictions.6

- Self-storage management fees (both on- and off-site) are about one-third of the overall expenses.1

- Direct construction costs for storage facilities is over $305 million.1

- Self-storage has around 70 percent net operating income (NOI), some of the highest for any type of real estate asset.1

- The most popular rent concessions among self-storage facilities include various specials—one month free rent, first month’s free rent, and half off the first month’s rent.1

Self-Storage Management Trends

Self-storage management fees (both on- and off-site) are about one-third of the overall expenses.

Cushman & Wakefield

Direct construction costs for storage facilities is over $305 million.

Cushman & Wakefield

On average, property taxes account for nearly a third of self-storage property expenses.

Cushman & Wakefield

Property taxes, management fees, and advertising are the top expenses for owners of storage facilities.

Cushman & Wakefield

The most popular rent concessions among self-storage facilities include various specials, one-month free rent, first month’s free rent, and half off the first month’s rent.

Cushman & Wakefield

Self-storage has around 70 percent of net operating income (NOI), some of the highest for any type of real estate asset.

Cushman & Wakefield

Self-Storage Industry Outlook

With positive predictions from experts, the self-storage market is running full steam ahead. These stats shed light on the industry’s projected growth and emerging trends.

- The self-storage market is forecast to be worth over $72 billion by 2029.15

- As of 2022, the market is expected to have a 5.76 percent compound annual growth rate (CAGR) over the next five years.7

- In 2022, the U.S. public storage and warehousing market employed more than 311,000 people.13

- Public storage and warehousing experienced a 5.2 percent employment growth.13

- The self-storage industry had a 7 percent annual employment growth from 2017 to 2022.13

- Emerging trends of self-storage operators include virtual tours, online booking and payment options, self-service kiosks, and automated access.7

Self-Storage Industry Outlook

In 2022, the U.S. public storage and warehousing market employed more than 311,000 people.

IBISWorld

The market is expected to have a 5.76 percent compound annual growth rate over the next five years.

Statista

Emerging trends of self-storage operators include virtual tours, online booking and payment options, self-service kiosks, and automated access.

Statista

The self-storage market is forecast to be worth over $72 billion by 2029.

Statista

Public storage and warehousing experienced a 5.2 percent employment growth.

IBISWorld

The self-storage industry had a 7 percent annual employment growth from 2017 to 2022.

IBISWorld

Custom Steel Buildings for Storage Facilities

Based on these statistics, self-storage business owners can expect the best from their investments. When it comes to constructing a warehouse or storage facility, metal is the building material of choice—it’s low maintenance, weather- and rot-resistant, and a sustainable material that is 100 percent recyclable.

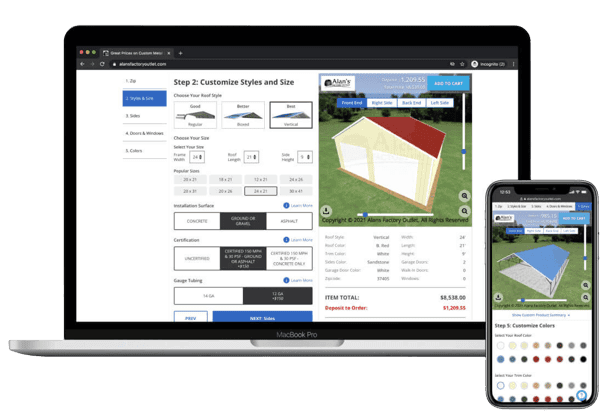

Our prefabricated metal buildings are quicker to assemble and cost-efficient in comparison to facilities built from the ground up. Use our 3D Tool below to customize and purchase a steel building in a few simple clicks.

Sources

- “Self-Storage: A Resilient Asset Class That Will Continue to Perform Well Through Downturn.” Report. 2020. Cushman & Wakefield. Accessed December 20, 2022. https://www.cushmanwakefield.com/en/insights

- Alexander Harris, “U.S. Self-Storage Industry Statistics,” Updated April 16, 2024. SpareFoot. Accessed May 13, 2024. https://www.sparefoot.com/self-storage/news/1432-self-storage-industry-statistics/

- 2021 Self-Storage Almanac. Report. 2021. Mini-Storage Messenger. Accessed December 21, 2022. https://www.ministoragemessenger.com/products/2021-self-storage-almanac/

- Chris Hudgins. Christie Moffat, “Self-Storage Occupancy Gains to Taper off, Leading to Growth Slowdown,” S&P Global Market Intelligence, n.d., https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/self-storage-occupancy-gains-to-taper-off-leading-to-growth-slowdown-67786868?utm_medium=social

- Investor Management Services. “Distribution of self-storage inventory worldwide in 2018, by region.” Chart. August 28, 2018. Statista. https://www.statista.com/statistics/984719/self-storage-inventory-usa-vs-rest-of-the-world-2018/

- “2015-16 Self-Storage Industry Fact Sheet,” January 7, 2015. Self Storage Association. Accessed December 19, 2022. https://www.selfstorage.org/Portals/0/Library/Public%20Library/Preamble%20and%20Fact%20Sheet%20(2015)%20July%202015.pdf?ver=vtsrBGwfp8t9H9MGtsKBxQ%3d%3d

- Nareit. “Leading self-storage REITs in the United States from 2019 to 2022, by market cap (in billion U.S. dollars).” Chart. November 1, 2022. Statista. Accessed December 20, 2022. https://www.statista.com/statistics/1337875/self-storage-reits-market-cap/

- “National Self Storage Report,” April 24, 2024. Yardi Matrix. https://www.yardimatrix.com/publications/download/File/5480-MatrixSelfStorageNationalReport-April2024

- Mordor Intelligence. “Value of self-storage market worldwide in 2020 and 2026 (in billion U.S. dollars).” Chart. September 14, 2021. Statista. https://www.statista.com/statistics/1036943/self-storage-market-value-worldwide-forecast/

- Maria Gatea, “Self Storage Widely Used Among Renters, with Gen Xers in the Lead,” RentCafe Rental Blog, September 16, 2022. https://www.rentcafe.com/blog/self-storage/self-storage-widely-used-among-renters-with-gen-xers-in-the-lead/

- Alexander Harris, “How Much Does a Storage Unit Cost in 2022?,” February 14, 2022. SpareFoot. https://www.sparefoot.com/self-storage/blog/16906-how-much-does-a-storage-unit-cost/

- Christof Baron, “Self-Storage in the United States,” Statista, 2021. https://www.statista.com/study/57592/us-self-storage-market/

- “IBISWorld – Industry Market Research, Reports, and Statistics,” October 31, 2022. https://www.ibisworld.com/industry-statistics/employment/public-storage-warehousing-united-states/.

- “U.S. Self Storage: Market Trends & Sector Outlook.” Report. 2022. Cushman & Wakefield. Accessed May 13, 2024. https://www.cushmanwakefield.com/en/united-states/insights/us-self-storage-market-trends-and-sector-outlook

- Mordor Intelligence. “United States Self Storage Market Size & Share Analysis- Growth Trends & Forecasts (2024-2029)” Report. 2024. Accessed May 14, 2024. https://www.mordorintelligence.com/industry-reports/united-states-self-storage-market

- Carlo Bianchi, et al. “Accelerating the Adoption of Energy Efficiency and Renewables in Warehouses and Distribution Centers” Technical Report. January 2023. Accessed May 16, 2024. https://www.nrel.gov/docs/fy23osti/83583.pdf