By now, you should have a pretty good idea about how much your garage will cost.

You know:

- The cost of the prefab garage you want, including installation

- The cost of permits

- The cost of a concrete foundation for your garage

Once you total those up, you’ll know the total cost of your project and how much financing you may need (if any). If you’ve got the cash you need to pay for everything, you just need to order your garage to get started. You only need to pay us a deposit when you order, which is usually between 10% and 17% of the total. The balance isn’t due until after the garage is installed (unless you are ordering a very large garage over $15,000, in which case 50% of the balance is due when your installation is scheduled). You can pay both amounts with any major credit card.

If you need a way to finance your garage, here are some options:

Second Mortgage or Home Equity Line of Credit (HELOC). If you’ve been paying off your mortgage or your house is worth more than what you paid for it, you probably qualify for a second mortgage or a line of credit on your house. Like your primary mortgage, these types of loans are secured by the value of your home.

As a result, the interest rate is usually very reasonable. A second mortgage is good for a one-time purchase. A HELOC is a line of credit that you can use again and again as needed. The line of credit will give you more flexibility for your project, and you can also use it for other large purchases or emergencies in the future. Some HELOCs are much more flexible than others, and rates vary, so it pays to shop around at local banks. If a bank turns you down due to insufficient income or equity, a local credit union might still consider giving you a loan. However, be prepared for extensive paperwork and some waiting time while your loan is processed and approved.

Zero-Interest Card. If you know you’ll be able to pay off the total in less than two years, a zero-interest credit card may be an option. Some cards don’t charge interest for up to 21 months. But you’ll need to check the terms carefully and make sure that your credit limit will be large enough to cover the necessary expenses.

Personal Loan. Many banks, credit unions, and peer-to-peer lending sites offer unsecured personal loans for large purchases. The interest rates are usually less than a credit card, but higher than a HELOC. You’ll also probably have to pay a one-time origination fee in addition to the interest, which adds to the total cost of the loan. A HELOC is usually a better choice than a personal loan—but you will probably be able to get a personal loan faster and with less hassle.

Cash-Out Refinance. If you have a high interest rate on your mortgage, a cash-out refinance could provide the funds you need for your garage and lower your interest rate. You might even be able to lower your mortgage payments. Remember that you’ll have to pay closing fees though, which can be expensive.

Place Your Order

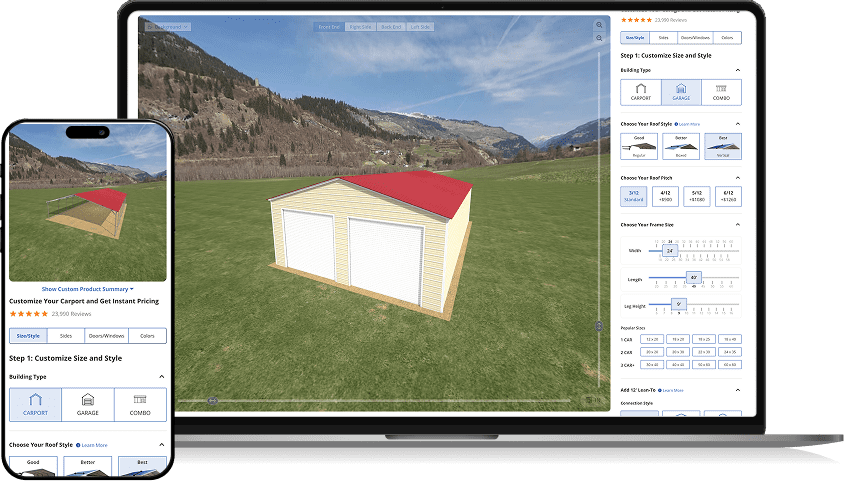

Once your financing is in place, you’re ready to order. If you’ve saved your design, locate the email with your design link and open it in the online designer. If you can’t find your saved design or want to start from scratch, visit the 3D Garage Builder on our website.

Once you have everything the way you want it, place your order and pay the deposit to lock in your price.

After you place your order, my team will send you information about requesting a permit and getting your site ready for installation. Then we will hold your order until your permit is issued and your site is ready. Once you have everything ready, we’ll notify the manufacturer, and your order will be put in a queue for scheduling. If you need to make customizations to your design that aren’t possible with the 3D Garage Builder, just give me a call at 1-800-488-6903.

In the next chapter, I’ll walk you step by step through the process of getting your permit.