At this point, you should have a clear estimate of your metal building’s total cost.

You are now aware of:

- The price of the prefabricated metal building you’ve selected, including installation

- The necessary permit costs

- The expense of a concrete foundation for your metal building

Once you’ve added everything up, you’ll have a clear estimate of your total project cost and any financing you might need (if applicable). If you already have the funds, all that’s left is to place your order for the metal building. A deposit—typically between 10% and 17% of the total cost—is required at the time of purchase. The remaining balance isn’t due until after installation. However, for extra-large garages exceeding $15,000, 50% of the balance must be paid when scheduling the installation. All payments can be made using any major credit card.

If you need a way to finance your metal building, here are some options:

Second Mortgage or Home Equity Line of Credit (HELOC). If you have an existing mortgage or your home has gained value since you bought it, you may be eligible for a second mortgage or a home equity line of credit (HELOC). Similar to a standard mortgage, these loans are backed by the value of your home.

Since they’re secured by your property, interest rates are usually quite competitive. A second mortgage is best suited for a one-time purchase, while a HELOC works as a revolving line of credit that can be used multiple times as needed. This flexibility allows you to fund your project and use the credit for other major expenses or emergencies. Some HELOCs are more adaptable than others, so it’s a good idea to compare offers from different banks. If your loan application is declined due to low income or equity, consider checking with a local credit union, as they may still approve your request. Be aware that this process involves significant paperwork and can take time for approval.

Zero-Interest Card. If you can repay the full amount within two years, a zero-interest credit card could be a good option. Some cards offer up to 21 months with no interest, but be sure to check the terms and ensure your credit limit covers the full cost.

Personal Loan. Many banks, credit unions, and peer-to-peer lending platforms offer unsecured personal loans for large expenses. Interest rates are generally lower than credit cards but higher than HELOCs. You may also need to pay an origination fee, increasing the total loan cost. While a HELOC is often a better option, a personal loan can be faster and require less paperwork.

Cash-Out Refinance. If your mortgage has a high interest rate, a cash-out refinance can provide funds for your metal building while potentially lowering your rate. In some cases, it can even reduce your mortgage payments. Keep in mind that closing costs apply, and they can be quite expensive.

Place Your Order

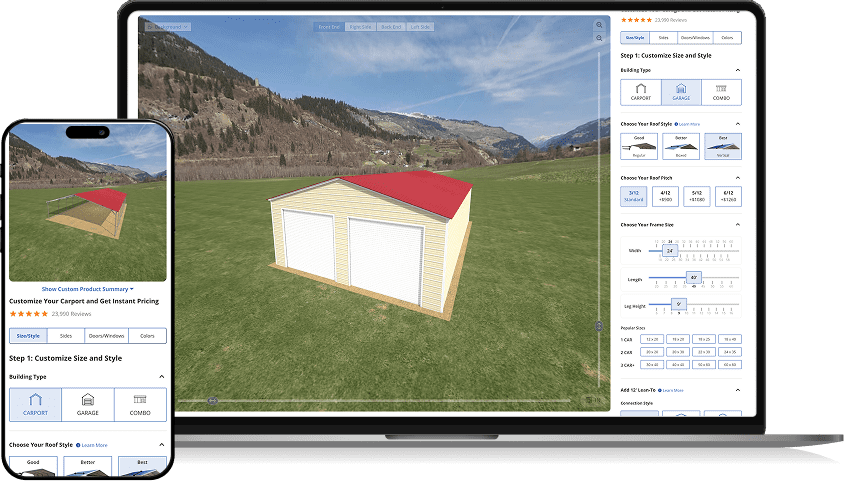

Once your financing is secured, you’re ready to order. If you’ve saved your design, open the email containing your design link and access it in the online builder. If you can’t locate your saved design or need to start fresh, visit the 3D Metal Building Builder on our website.

When everything looks good, submit your order and pay the deposit to lock in your price.

After placing your order, my team will provide details on permit applications and site preparation. Your order will be held until your permit is approved and your site is ready.

Once you have everything ready, we’ll notify the manufacturer, and your order will be put in a queue for scheduling. If you need to make customizations to your design that aren’t possible with the 3D Metal Building Builder, just give me a call at 1-800-488-6903.

In the next chapter, I’ll guide you step by step through the permit process.