Picture this: You’re finally on that bucket list cross-country trip you’ve been dreaming about for ages, your recreational vehicle humming along smoothly down the highway. Suddenly, out of nowhere, another car swerves, there’s a sickening crunch, and your dream trip comes to a screeching halt.

Your first thought might be, “Thank goodness I have insurance!”

But then comes the worry. Will it cover this?

What does RV insurance cover, exactly?

It’s smart to know the answer to that question before you need it. This guide clearly explains typical RV insurance coverage, points out what RV insurance doesn’t cover, and offers tips to protect your investment. Understanding your policy brings peace of mind for all your adventures.

Why Your RV Needs More than Just Basic Auto Insurance

Insuring your recreational vehicle (RV) isn’t like insuring the car or truck you use to commute daily. Your Motorized RV or motorhome is both a vehicle and a home on wheels. It faces unique risks on the road and at the campsite.

Specialized RV insurance is designed for this dual purpose.

Do note that RV insurance isn’t the same as travel trailer insurance, but we’ll get back to that in a moment.

It’s Not Your Everyday Auto Policy

Your standard auto insurance policy for your car or pickup truck isn’t built to handle everything that can happen with an RV. It mainly focuses on liability and damage while driving. On the other hand, RV insurance policies often include options that your regular auto policy wouldn’t dream of covering.

Here’s a quick comparison:

| Feature | Standard Auto Insurance | RV Insurance |

|---|---|---|

| Primary focus | Driving liability & vehicle damage | Driving liability, vehicle damage, & living use |

| Personal belongings | Generally not covered | Often covered with personal effects coverage |

| Campsite liability | Not applicable | Often available through vacation liability coverage |

| Special equipment | Limited or no coverage | It can cover permanent attachments |

| Full-time use | Not applicable | Offers full-timers coverage options |

| Emergency expenses | Usually not included | Often available (lodging, transport) |

While some basic ideas like liability insurance or covering crash damage (collision insurance) seem similar, RV insurance goes much further to protect your unique investment and lifestyle.

The Core Four: What does RV insurance cover?

Most RV insurance policies start with four foundational coverages. You won’t need all of them in every state, but understanding all four helps you know where your protection begins.

Let’s see what the four core coverages are.

Liability Coverage: Protecting Others on the Road

This is usually the part of RV coverage required by law, just like with your regular car. Liability coverage doesn’t pay for your RV or your injuries. It pays for damage or injuries you cause to other people or their property if you’re deemed at fault in an accident.

It’s broken down into two main parts:

- Bodily Injury Liability (BI) or Personal Injury Protection (PIP): Helps pay others’ medical expenses and related costs.

- Property Damage Liability (PDL): Helps pay for damage to others’ vehicles or property.

Having solid liability protection is crucial because costs from bodily injury or serious property damage can add up quickly.

RV Insurance Collision Coverage: Fixing Your RV After an Accident

Liability coverage covers other drivers and vehicles in the event of an accident. However, collision coverage helps pay to fix your RV if it’s damaged in a crash with another vehicle, if it hits an object (like a pole or guardrail), or even in a rollover.

This coverage against collisions applies whether the accident was your fault or not.

You’ll typically pay a deductible first. This is a vital part of the broader physical damage coverage.

Uninsured and Underinsured Motorist Coverage: When Others Lack Insurance

What happens if someone hits you and they have little or no insurance? That’s where uninsured motorist coverage (UM) and underinsured motorist coverage (UIM) come in.

This coverage steps in to help pay for your expenses in that situation. It usually includes:

- UM/UIM Property Damage: Can help cover repairs to your RV (varies by state).

- UM/UIM Bodily Injury: Covers your medical bills and related costs.

Legislations regarding uninsured motorist laws vary, but this underinsured motorist coverage is often a smart protection against irresponsible drivers.

Comprehensive Coverage—a.k.a. “Other than Collision” Coverage

This is the other main part of physical damage coverage for your RV itself. Comprehensive coverage (often called “Comp” or “Other Than Collision”) handles damage to your RV caused by things other than a crash with another vehicle.

It covers many unfortunate events.

Think of things like:

- Falling objects (like tree branches)

- Collisions with animals

- Storms (hail or wind)

- Theft or vandalism

- Flooding

- Fire

Like collision coverage, you’ll usually have a deductible for comprehensive claims. This coverage is super important because it protects your recreational vehicle even when it’s parked at a campsite or in storage space.

Popular Optional RV Insurance Coverages for Added Peace of Mind

You can purchase add-ons to your insurance policy for optional coverages to customize your protection. These extras provide valuable security for specific situations.

Medical Payments Coverage

Often called MedPay, medical payments coverage helps pay your passengers’ and your medical bills if you’re injured in an accident, regardless of fault.

Roadside Assistance

Roadside assistance helps with towing, flat tires, dead batteries, or fuel delivery if you break down far from help.

Vacation Liability

This liability protection provides additional coverage if a guest is injured at your campsite while your RV is parked.

Emergency Expense Coverage

Emergency protection helps cover lodging and transport if your RV is unusable after an accident far from home.

Pet Injury Coverage

Coverage for pet injuries helps pay vet bills if your pet is injured in a covered accident while in the RV.

Personal Property Coverage

This personal property coverage protects your personal items (clothes, electronics, gear) inside the RV from covered damage or theft.

Full-Time RV Coverage

Full-time coverage is essential if the RV is your primary residence, acting more like homeowners insurance with higher limits.

Pest Protection

Some insurers offer this add-on since standard policies often exclude damage from critters like mice or insects.

Total Loss Replacement

Total loss coverage helps you replace a totaled newer RV with a similar new one, not just its depreciated value (replacement cost coverage).

Add-on Protection for Key Exterior Parts

Some expensive RV parts can get specific additional coverage options, such as the following:

- RV Awning Damage: Awnings are prone to damage; ensure your comprehensive coverage or collision coverage limits are sufficient, or ask about specific awning coverage.

- Windshield Replacement: This helps cover the high cost of replacing large RV windshields, often with low or no deductible.

- Roof Protection: This offers coverage specifically for roof damage, sometimes with a lower deductible.

What RV Insurance Doesn’t Cover

Knowing the common exclusions—what RV insurance does not cover—is just as crucial. No policy covers everything.

Insurance for Travel Trailers or Camping Trailers

While you can get travel trailer insurance, damage to towable units isn’t automatically covered by the tow vehicle’s policy. You need specific coverage for physical damage (Comprehensive and Collision) to the trailer itself. Always check your policy descriptions.

Personal Articles Inside Your RV

As mentioned, basic RV insurance covers the vehicle. Your clothes, electronics, jewelry, bikes, etc., usually need optional personal effects coverage or might have limited coverage under your homeowner’s insurance.

Your RV’s Wear and Tear

Insurance covers sudden accidents, not gradual decline. Rust, engine failure from age, worn-out seals, or paint fading from sun exposure usually aren’t covered. Protecting your RV from the elements with proper storage, like an RV carport, is important because insurance won’t cover this wear.

Commercial Use of Your RV

Using your RV for business (e.g., renting it out, using it as a mobile office, etc.) typically requires a separate commercial policy. Personal RV insurance policies generally exclude claims related to commercial purposes.

Damage Due to Some Natural Disasters

While Comp covers some weather (acts of nature), major events like earthquakes and floods are often excluded and may require separate coverage. Check the exact details regarding natural disasters in your policy.

Smart Storage Solutions: Protecting Your RV Where Insurance Might Not

RV insurance coverage is great for accidents, but it doesn’t cover slow damage from the elements. The sun fades paint and ruins tires, rain causes leaks, and hail leaves dents—insurance usually calls this wear and tear and won’t pay.

That’s where good RV storage helps. A sturdy metal RV carport shields your rig from sun, rain, hail, and falling debris, preventing damage insurance exclusions. It’s a cost-effective way to keep your RV looking good.

An enclosed metal RV garage is your best bet for top-notch protection against weather, pests (which insurance might not cover!), and theft.

It keeps your investment safe and sound, preserving its value where insurance leaves off.

RV Insurance Requirements When Traveling in the US

Just like with car insurance, the minimum RV insurance required varies quite a bit from state to state. Nearly every state requires you to carry at least liability coverage (bodily injury and property damage liability) for a driveable motorhome.

Some states, like California, don’t require separate insurance for towed toy haulers, travel trailers, or fifth wheels (Source: RV Living).

Minimum liability limits also vary.

For example, Florida requires a minimum of $10,000 in PIP and PDL for each (Source: FLHSMV). Other states require $50,000 or more. Some states also require uninsured/underinsured motorist coverage or personal injury protection.

RV Insurance Deductibles, Limits, and Rates

When you’re looking at RV insurance quotes, you’ll hear these three terms a lot:

- Deductible: This is the amount you pay out-of-pocket on a Comprehensive or Collision claim before your insurance company starts paying. Choosing a higher deductible before coverage kicks in usually lowers your premium (your regular payment) but means you pay more if you have a claim.

- Limits: This is the maximum amount your insurance policy will pay out for specific types of coverage. For liability coverage, limits are often shown like 50/100/25 ($50k bodily injury per person / $100k bodily injury per accident / $25k property damage per accident). Choosing higher coverage limits provides more protection but increases your premium.

- Rates (Premium): This is simply the insurance cost—what you pay for the policy (annually or in installments). Rates depend on your RV, driving record, location, chosen coverages, limits, deductibles, and more. According to Ramsey Solutions, costs range from $600 to $3,000.

Understanding how these work together can help you choose a level of coverage that fits your budget while still providing adequate protection. Don’t be afraid to ask your insurance agent to explain different scenarios.

Covering Your Adventures: Protecting Your RV Both on the Road and at Home

Hitting the open road in your RV offers a special kind of freedom. Making sure you have the right recreational vehicle insurance coverage is a big part of keeping those adventures worry-free. It protects you from the financial sting of accidents, theft, and other mishaps that can happen unexpectedly.

Answering the questions “What does RV insurance cover?” and “What does RV insurance not cover?” is key. By choosing the right basic coverages and adding optional coverages that fit your travel style, you can feel secure on the road.

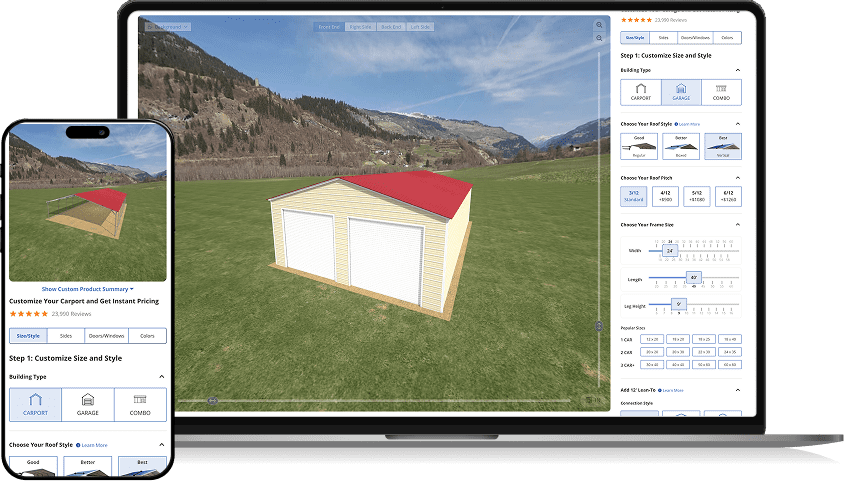

And don’t forget that protecting your investment goes beyond insurance. Proper storage, like a durable metal RV carport or garage from Alan’s Factory Outlet, safeguards your RV from the elements and everyday wear that insurance won’t handle, keeping it ready for your next journey.

Check out our selection of high-quality metal buildings or customize your own with our 3D Builder. We offer free delivery and installation in 21 states and are standing by to help you protect your RV.

What does RV insurance cover? And Other Frequently Asked Questions

As a quick review, basic RV insurance offers the following coverage:

- Liability Coverage

- Collision Coverage

- Uninsured and Underinsured Motorist Coverage

- Comprehensive Coverage

Here are quick answers to a few more common questions folks have about RV insurance:

How much does RV insurance cost?

The cost of RV insurance varies greatly depending on the RV’s type and value, the coverages and limits you choose, your driving history, where you live, and how you use it (full-time vs. recreational). Getting quotes from multiple insurance providers is the best way to find a competitive price. Generally, it costs more than basic auto insurance but less than insuring a home.

Do I need a separate policy if I only have a travel trailer?

Usually, yes. Fifth-wheel trailers or towed pop-up campers aren’t covered by RV or motorhome insurance. Insurance companies only consider RVs that can drive on their own, like motorhomes and other motored RVs.

Truck campers are a bit of a grey area that may or may not be covered by your truck’s insurance.

You’ll likely need a specific conventional trailer insurance policy (or add a rider to your auto policy) to cover collision or comprehensive damage for the actual travel trailer.

Does RV insurance cover water damage?

It depends. If the water damage is caused by a sudden, accidental event covered under your Comprehensive policy (like a storm ripping off part of the roof), then likely yes. However, damage from slow leaks, wear and tear (like old seals), or flooding (which often requires separate coverage) is usually not covered.

Is the stuff inside my RV covered?

Usually, the basic RV policy itself doesn’t cover the contents of the RV. You typically need to add Personal Effects Coverage or Contents Coverage as an optional add-on to protect your belongings like clothes, electronics, and gear inside the RV. Check your homeowner’s insurance, too, as it might offer some limited coverage for personal property away from home.