When it comes to getting a durable, affordable shelter, two popular paths stand out: rent-to-own carports and traditional financing options. Both help you spread the cost of your metal building with monthly payments, but they work differently; knowing those differences can save you money and stress.

Rent-to-own is simple: You make a small upfront payment, then continue with affordable monthly payments until you eventually own the structure. It’s especially appealing for folks looking for no-credit-check carports or flexible start terms.

But rent-to-own also has trade-offs. It usually costs more over time, and if you stop paying, the carport could be repossessed.

On the other hand, AFO’s carport financing offers low deposits, 0% APR for qualified buyers, and lower total costs in the long run, making it a wise choice for those who want to save.

This quick guide breaks down the pros and cons of each option so you can confidently choose the payment option that works best for your budget and goals.

What Is a Rent‑to‑Own Program?

Rent-to-own can be a cost-effective way to purchase something:

- As a renter, you pay a small down payment or initial fee up front.

- As part of the payment terms, you make regular monthly payments for a set term

- At the end of that term, you own the metal structure once payments are complete.

So until then, you’re renting with the agreement that you’ll purchase later (if you fulfill all terms).

Why It’s Appealing

Many RTO programs don’t require a strong credit history (or any credit check). That means people with less established credit can still get a carport. And down payments are usually modest compared to buying outright, so you can get the carport sooner.

Common Terms and Options

When you rent to own, you’ll commonly enjoy benefits like:

- Early payoff. Some programs let you pay off the remaining balance ahead of schedule, which can save on interest/extra costs.

- Flexible payment schedule. Depending on the company, you can adjust payment frequency or negotiate payment amounts.

- Customization options. You may be allowed (or required) to choose certain finishes, features, or add‑ons up front, sometimes affecting cost.

Risks and Costs To Watch Out For

One risk is a higher total cost over time. The cumulative cost may be much more than buying or financing directly because of fees, sometimes inflated pricing, or higher payment schedules compared to standard financing. Consumer advocates have documented that rent‑to‑own goods often cost two to four times the cash price plus fees.

There’s also the risk of repossession. If you miss payments, the company can reclaim the building. Forward payments might not count toward ownership if the contract is ended early.

Lack of consumer protections is another thing to watch out for. Because many RTO agreements are structured more like leases than loans, they often aren’t covered by all of the usual credit laws (like Truth in Lending). That means fewer disclosures, less regulation.

How Much More Does RTO Cost?

RTO purchases can cost over 200% more than buying the same product up front or via traditional financing, depending on fees, term length, and the number of payments made.

Downsides of Rent-to-Own Carports

One key disadvantage of choosing the rent-to-own option over financing or paying up front is the higher overall cost. After all the monthly payments, fees, damage or loss protections, the total you pay via RTO is often significantly higher than if you financed through a lender or bought outright. Depending on the contract, the aggregate cost may be 1.5 to 4.5 times the retail value.

Another disadvantage is the limited customization options compared to financing. Companies offering RTO often restrict what you can do to the item (color, size, features); heavy modifications or upgrades may void the contract or incur extra fees.

There’s also the delay in ownership until contract ends. You don’t own the carport until every payment (and usually any fees/late charges) are paid. If you want to sell, relocate, or modify it significantly before it’s fully paid off, you may not have the right to.

Common Risk for Both RTO and Financing

Whether you lean toward RTO or traditional financing, repossession is a risk if you miss payments. Many RTO contracts allow the company to reclaim the carport if payment obligations aren’t met. Financing can also lead to repossession or default penalties if payments are missed. So affordability is key: Choose a carport and payment plan you can afford.

Alan’s Factory Outlet Financing Options and Payment Plans

If you’re considering a rent-to-own carport from Alan’s Factory Outlet, there are a few things to keep in mind:

- AFO does not offer in‑house rent‑to‑own or direct financing.

- However, we provide ways for you to finance the purchase through third parties (e.g., lenders or bank loans)

- The deposit amount is fairly low, often 10%-17% of the total. Once the structure is delivered and installed, the balance is due.

- You get complete ownership immediately once you’ve made an up-front full payment (i.e., after installation and paying the balance), rather than monthly “rent” payments that only convert into ownership at the end.

- AFO emphasizes transparency: instant online pricing, no surprise fees, no hidden costs.

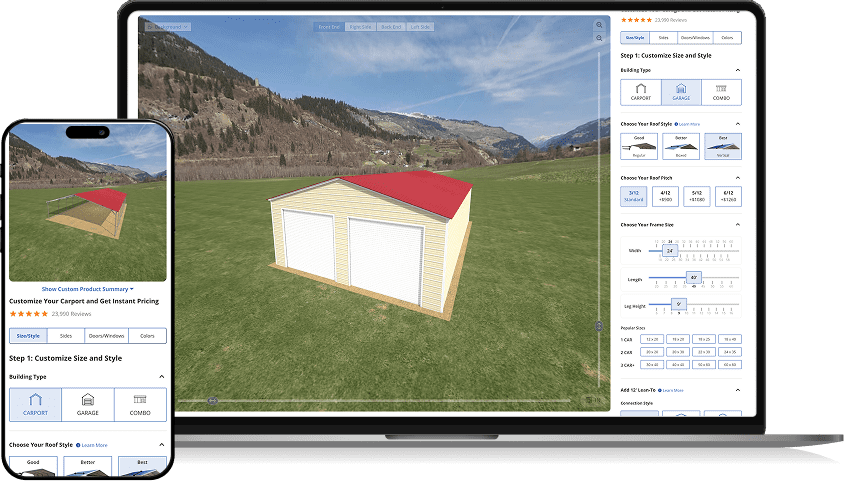

- AFO’s product line is broad: steel carports, garages, RV covers/storage buildings, and metal buildings of many styles and uses. Custom sizing, roof types, colors, and side panels are options.

Customer Testimonials

These verified reviews show people feel satisfied with both the products and the process:

“The service was great from ordering it to the finished product.”

— James Lester, Louisa, KY

“I purchased a few buildings from Alan’s Factory Outlet. I’ve been very pleased with the quality of service and the quality of the products. If Alan says he’ll do it, he’ll do it.”

— BJW, Luray, VA.

Side-by-Side Comparison: Rent-To-Own vs. Financing

Choosing how to pay for your metal building is just as important as choosing the building itself. Whether you’re considering rent-to-own carports or more traditional financing options, the right decision depends on your credit, budget, and long-term plans.

The table below compares the two options based on major financial factors. Make sure your payment plan fits your current needs and future goals.

| Rent-To-Own vs. Financing | ||

|---|---|---|

| Feature | Rent-to-own carports | Carport financing options |

| Credit requirements | No credit check required (ideal for poor/no credit) | Soft credit check may apply |

| Ownership timeline | Ownership granted after all payments are made | Immediate ownership after payment/install |

| Total paid over time | Higher total cost due to fees and markups | Lower total cost with low or 0% APR |

| Flexibility | Limited customization and product selection | Full access to AFO’s product catalog |

| Risks | Risk of repossession if payments stop | Missed payments may affect credit score |

Both options offer monthly payment plans and ways to afford your metal building without paying the full cost up front. But if you qualify, financing through AFO often leads to lower overall costs and more freedom to choose the features you want.

Benefits of Financing Your Carport Through AFO

Studies in consumer finance and construction economics show that financing (especially with low interest, transparent terms) helps spread out upfront cost, lowers the premium you pay over the long term, and avoids inflated “lease‑purchase” markups. That makes owning steel buildings (carports, garages, metal garages with an A-frame) more affordable over time, as a higher upfront cost is balanced by lower interest and fewer fees.

Let’s review the key advantages of AFO financing/payment plans:

- Affordable deposits and low‑interest rates. Rather than paying the whole amount up front, you pay a small deposit and monthly payments with a competitive 0% or low APR.

- Transparent terms with no hidden penalties. You can know exactly what you owe, when, and what happens for missed payments.

- Full style range. You can access AFO’s full catalog: vertical roof, boxed eave, regular roof, A‑frame, and custom metal building options—more style/fitting options than many rent‑to‑own providers allow.

- Supports durable structures beyond just carports. With financing, you can afford more robust steel building types: metal garages, RV covers/RV carports, storage buildings, and steel structures built to last. These tend to have better resale, utility, and durability.

Make the Smart Choice for Your Metal Building

Rent-to-own offers hassle-free, short-term convenience, no credit checks, and lower upfront costs, but often comes with higher long-term pricing, delayed ownership, and limited options. Financing, especially through Alan’s Factory Outlet, gives you more flexibility, lower total cost, and immediate ownership of your custom metal building.

With affordable financing options, transparent terms, and access to a full range of products, from vertical roof carports to RV covers and metal garages, AFO makes it easy to get the structure you need without the hassle.

Ready to start building? Request a free quote and explore the best carport financing options available today.

Get pre-approved now and get your dream building with Alan’s Factory Outlet.

FAQs

Many buyers wonder about affordability, credit requirements, and how much they can customize their metal building. Let’s go over some quick answers to those common concerns.

Can I get a carport without a credit check?

Yes. A rent-to-own option often advertises no-credit-check carports. But Alan’s Factory Outlet doesn’t offer RTO. Instead, AFO provides carport financing with accessible terms like low deposits and instant approval options, while still giving you ownership once payments are made. For full details, see AFO’s financing options.

How much would it cost to build a 20×20 carport?

Costs vary depending on materials, roof style, labor, permits, and customization. According to industry guides, a basic 20×20 metal carport can cost $1,700-$2000 or more if it’s simple and uses standard panels. With more durable steel, custom roof styles (vertical, boxed‑eave, etc.), and installation, many estimates are $5,000‑$15,000.

Financing spreads these costs over time, making it much more manageable than high monthly RTO payments.

How does a rent-to-own program for a carport work?

The RTO process is simple:

- You make a down payment and monthly payments over a fixed term.

- Once all payments are completed, you own the carport.

- If you miss payments, there’s a risk of repossession.

Are there early payoff penalties if you rent‑to‑own a carport?

It depends on the RTO provider. Some allow early payoff, but you usually still pay more overall than financing, and there may be extra fees or terms in the fine print. Financing is generally the smarter choice if you can pay it off early, since there are fewer markups and more benefits to reducing interest.

Can I customize my rent‑to‑own carport?

Yes, but customization is often limited compared to buying or financing. If you go with financing (like through AFO), your customization options are much broader.

Custom options include roof style (vertical, regular roof, boxed‑eave), color options, lean‑to or enclosures/side panels, and RV cover or additional bays.

With financing, you likely get the full catalog of possibilities; with RTO, customization may cost extra or be restricted.